The Australian Taxation Office (ATO) is looking more closely than ever before at our claims for work-related car expense claims. This is a good enough reason to go over your tax-claiming practices and make sure you are 100% squeaky clean.

Why is this particular type of claim under the magnifying glass of the ATO?

According to Kath Anderson, the ATO assistant commissioner, the reason is the unusually high percentage of work-related car expense claims during previous years.

Anderson told The Australian that more than 40 per cent of all work-related deductions were car expenses. This adds up to billions being drained from the tax system and is clearly why the ATO has chosen to spotlight this issue.

A potential solution is the Easy 12-week Tracking with GOFAR ATO Logbook App, but let’s look more deeply into the issue of tracking.

There are two things you need to take away from this article:

Perfect for drivers who cover more than 5,000 km a year for work purposes.

“Ms Anderson said enhanced ATO technology made it easier to detect potential tax rorters, revealing nearly 3.75 million people claimed the expense last year at a cost of $8.8 billion.” – Kath Anderson for The Australian

What You’ll Learn

You can only claim expenses that are work-related and that have not been reimbursed to you in any other way. This is the same regardless of whether you drive a company-owned car, leased vehicle or your own car.

The following work-related travel expenses fall into that category:

These potential expense claims DO NOT include:

Let’s repeat this one more time, since it is extremely important – you can claim these expenses only if they haven’t been reimbursed to you by your employer.

“In other words, you cannot claim expenses that have already been paid by your employer, including salary sacrificing arrangements.” – Kath Anderson for Business Insider Australia

Now, let’s just take a quick moment to clear up some details and explain which vehicles you use that can be considered.

You can claim expenses when it comes to:

It is clear enough what a motorcycle is, but let’s define what the ATO considers to be a “vehicle other than a car”. This includes all vehicles that can carry more than a tonne load OR nine or more passengers.

These include mini-vans, trucks, panel vans and similar means of transport.

Here is a good illustration of what can and cannot be claimed as an ATO car expense:

Those who can claim work-related travel expenses are:

As a company or trust, you can use the actual costs method to claim the following:

As a sole trader, most of the rules above apply to you. You can also claim the following:

However, if you work from a home office you can also claim some of those expenses. Again – only if you are driving the car for business purposes.

Sole Trader Example

Let’s say you are an interior designer who works from home. If you are going to a restaurant to discuss business with a restaurant owner and examine the place that needs to be decorated – you are entitled to claim expenses.

If you are going for dinner and you happen to get approached by the restaurant owner who heard you are a designer and wants to hire you – this is not something you can claim.

If you are going out to meet friends, spot great wallpapers that are perfect for your restaurant project, go in and buy them – but this is still not a business-related expense.

In other words, your purpose needs to be work-related in order to be able to claim the expenses.

Employees can claim travel-expense deductions if:

The employee must consider all the aspects of their job, both the official terms and the actual practice. They shouldn’t consider just one aspect to determine whether the expense is deductible.

The table below highlights travel-related expenses employees can claim and which ones are not.

| Travel Expense Type | ATO Deductible | Conditions/Notes |

| Travel between work locations | Yes | Both locations must not be the employee’s home. |

| Travel required by employer | Yes | Must occur during work hours and under employer’s direction. |

| Travel from home to a regular place of work | No | Even if minor work-related tasks are completed en route. |

| Car operating costs with employer-provided car | No | If the car is for exclusive use and allowed for personal reasons. |

| Travel to clients or other locations for work | Yes | Must be required for employment duties. |

| Travel for private purposes or convenience | No | Includes travel to a workplace for private reasons before heading to the regular office. |

| Parking and toll fees for work-related car use | Yes | – |

Work-related Car Claims Example for an Employee

Michael is a Safety Officer in a factory. His tasks include making sure all the danger signs are positioned and that safety is ensured for everyone in the factory. He is also obliged to go to regular seminars and training when needed.

If Michael uses his car to drive to a work-related seminar that his employer asked him to attend, he can claim car expenses.

If Michael drives a company car to work every day, saying that he has to carry danger signs on and off work, the situation is different.

Generally, he cannot claim car expenses for this, unless in the following situations:

All that has been explained so far is mostly referring to the company employees. To some degree, there are differences in tax claiming if you are claiming taxes as an employee or if you are claiming as a sole trader or as a company.

There are two methods to do this: the cents per kilometre method and the ATO logbook method. To decide which method to use, you first need to determine whether you drive over 5,000 kilometres a year for business or not.

Knowing what you can and cannot claim is the first step of your road toward neatly and tightly done taxes. The next step is to understand how to calculate your deductions.

Here are some more detailed explanations about both of these methods that are recommended to calculate work-related travel expenses.

Best for: Those who want to claim less than 5000 km travelled

The standard rate per kilometre is 85 cents in 2023-24. This rate includes all the expenses of your vehicle, including depreciation. To calculate your claim value, you multiply 85c by the total business kilometres travelled.

Rate per Kilometre By Financial Year:

While you don’t need written evidence, it is important that you can explain and support your calculations during a possible audit.

Using a good and reliable ATO logbook app such as GOFAR (which has over 1000 four and five star ratings on the app store) is the most convenient way to do this.

It tracks my car travel fine. Easy to tag specific trips as business-related for reporting purposes at tax time. Anthony Bennett, Verified Customer, Oct 2020

Here is an example of this type of calculation, with the 2022-23 price per kilometre rate, which was 78 cents:

Practical Example

“James is a carpenter and carries bulky equipment to and from work as there is no secure lock up on site. James has kept a log book for 12 weeks which shows his work travel is 95%. James purchased a Toyota Hilux which has a 2 litre engine on 01/07/2019 for $25,000 which he financed through a hire purchase chattel mortgage at an interest rate of 6%. His odometer reading on 30 June 2022 was 25,000 kms and his car does 500 kms on a 55 litre tank of petrol. The average cost for petrol in QLD was $1.95 per litre.” – Source: David Douglas Accountants

Here is more valuable information from Thompsons Australia which will help you keep on track when using the cent per kilometre method:

“Business kilometres under the cents per kilometre method is determined by ITAA 1997 s 28-25(3). These are kilometres the car travelled in the course of:

The idea of “reasonable estimate” does not have any further clarification in the tax law and takes its ordinary meaning. From a practical perspective: irregular work-related travel would need to be specifically listed down in a written record, and regular work-related travel (say between two work sites) may be calculated with reference to the number of trips made.

The written evidence of business kilometres travelled for an income year under the cents per kilometre deduction must be retained for five years. There is no need to lodge it with the income tax return, however, details relating to the calculation will be the initial question asked by the ATO in a review.” – Thompsons Australia

Best for: Those who want to claim more than 5000 km travelled.

You should use the ATO logbook method if you exceed the 5,000 km limit.

It means you need the best ATO logbook app, like GOFAR and a way to track all your work-related car expenses.

Now, let’s get into the details of your ATO logbook.

Here is what it needs to contain:

You need to do something quite similar for each of your journeys:

“Your claim is based on the business use percentage of each car expense. This is determined by a log book that must have been kept for a minimum 12-week period, and must be updated every 5 years. Through your ATO logbook you can claim all expenses that relate to the operation of the car, at your percentage of business use.” – H&R Block Tax Accountants

If you have more than one vehicle, keep in mind that the 5,000 km limit is per vehicle and not per person. Still, if you exceed this, it’s time to learn how to do the ATO logbook method properly.

To properly claim your expenses in this way, you need to keep track of all the receipts. The necessary receipts will include those for car maintenance and insurance.

As for the fuel, it can be calculated from the odometer readings. Here is an example of the ATO logbook method from ATO Tax Rates Info.

Here is an example and a neat explanation of the ATO logbook method:

“At the end of the 12-week period, the work-related percentage can be determined. To do this, divide your business use kilometres by your total kilometres, then multiply by 100. For example: You’ve travelled a total of 5,000Km; 3,000km related to work, the calculation is therefore 3,000 / 5,000 x 100 = 60%.

Now that you’ve determined your work-related percentage, it’s important to know what expenses you are entitled to include as part of your claim. These expenses include:

Your total motor vehicle expenses are added up and then apportioned based on your ATO logbook percentage. Continuing on with the above example, your ATO logbook percentage is 60% and your total motor vehicle expenses are $10,000 so your deduction will be 10,000 x 0.60 = $6,000.”

The GOFAR app boasts 400+ 5-star reviews on the Google Playstore. Find out why other drivers find the GOFAR the fastest and easiest log book app available.

There are different ways to keep a valid ATO logbook. You can use the e GOFAR adapter with an ATO logbook app, a mobile app, a simple spreadsheet or even just pen and paper.

ATO created a basic app themselves. You can see if it works for you and your business:

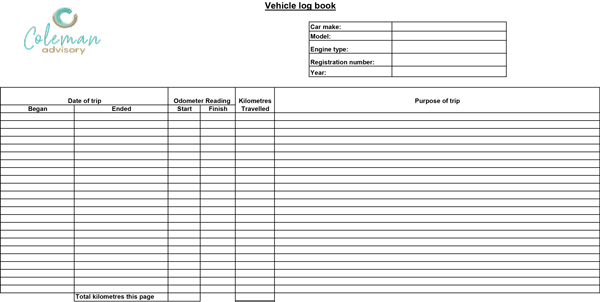

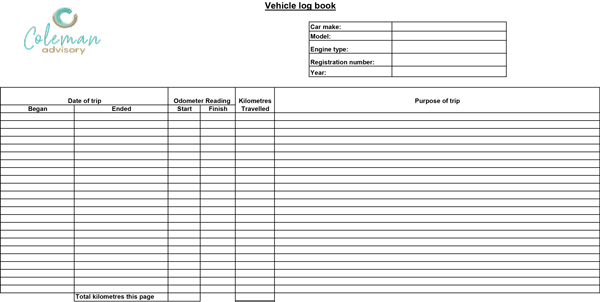

You can print out the template that was created by the Synectic group and enter your data manually:

For those that like to keep all their records in Excel, here is one that Coleman Advisory created.

Also, here is a video created by Ascent Accountants, explaining, step by step, how to use a spreadsheet ATO logbook.

However, for those who really want to make this method as easy as possible, they can simply use the GOFAR adapter. It works with cents per kilometre as well and it helps keep valid records.

Once you have your logs all sorted out and ready, visit the ATO website and put them into the online Work-related car expenses calculator.

The big change in the Australian tax return system happened on 1st July 2015. Before this date, there were 4 different ways to your work-related car expense deductions. The first two are still in use today.

The second two are NO LONGER in use:

The cents per kilometre method was allowed only for those who drove less than 5 000 km a year. For more kilometres, the remaining three methods were used. Only the ATO logbook method could be used regardless of the kilometres driven.

Are you wondering which method is the best one for you? The table below compares the logbook method and the cents per kilometre method to help you choose.

| Logbook Method | Cents Per Kilometre Method | |

| Basis of Calculation | Based on the business use percentage of the car’s expenses over the logbook period. | Based on a set rate per business kilometre travelled (up to 5,000 km per car). |

| Documentation | Requires a logbook maintained for a 12-week period, plus all expense receipts. | Requires a diary of work-related journeys or a reasonable estimate. |

| Claimable Expenses | All car expenses, including depreciation, can be claimed proportionally. | Only the cost of using the car for work-related travel is claimable. |

| Claim Limit | No limit as long as expenses are justified and documented. | Limited to 5,000 business kilometres per car, per year. |

| Flexibility | High, as it allows for claiming a percentage of all car expenses. | Low, as it only allows for a claim based on kilometres travelled. |

| Suitability | Best for those who travel extensively for work and have high vehicle expenses. | Suitable for those who do not travel extensively for work. |

| Ease of Use | Requires more detailed record-keeping and calculations. | Simpler and requires less documentation. |

| Depreciation Claim | Yes, depreciation can be claimed proportionally. | No, depreciation is not claimable. |

| Accuracy | High, as it is based on actual expenses and business use. | Lower, as it is an estimate based on a flat rate. |

Another change happened in 2016, which affected the cents per kilometre method. Up to 2016, the price per kilometre depended on the size of your car engine. Ever since 2016, it’s been the same for all vehicles.

| Tax Year(s) | Price Per Kilometre |

| 2023 – 2024 | 85 cents |

| 2022 – 2023 | 78 cents |

| 2021 – 2022 | 72 cents |

| 2020 – 2021 | 72 cents |

| 2018 – 2020 | 68 cents |

| 2015 – 2018 | 66 cents |

Before this change, this is how the prices looked:

| Tax Year | Ordinary Engine | Ordinary Engine 1,601–2,600cc Rotary Engine 801–1,300cc | Ordinary Engine >2,600cc Rotary Engine >1,300cc |

| 2014 – 2015 | 63 cents | 74 cents | 75 cents |

| 2013 – 2014 | 65 cents | 76 cents | 77 cents |

| 2012 – 2013 | 63 cents | 74 cents | 75 cents |

| 2011 – 2012 | 63 cents | 74 cents | 75 cents |

| 2010 – 2011 | 63 cents | 74 cents | 74 cents |

| 2009 – 2010 | 63 cents | 74 cents | 75 cents |

| 2008 – 2009 | 63 cents | 74 cents | 75 cents |

| 2007 – 2008 | 58 cents | 69 cents | 70 cents |

| 2006 – 2007 | 58 cents | 69 cents | 70 cents |

| 2005 – 2006 | 55 cents | 66 cents | 67 cents |

Penalties and their amounts depend on many factors. The factors taken into consideration include whether it is a late payment, incomplete payment or a missing payment.

Also, the amount of tax plays an important role. And last, but not least, it is critical whether you have knowingly tried to commit fraud or made a genuine mistake.

When it comes to car allowances, the Australian Taxation Office (ATO) is particularly vigilant.

If you receive a car allowance, which appears on your payslip, it is imperative to declare it as part of your taxable income, adhering to the car allowance ATO guidelines. This is because the ATO has measures in place to prevent ‘double dipping,’ which occurs when an individual claims more in deductions than they are entitled to.

The ATO relies on the fact that Australian citizens pay their taxes accurately and on time. However, that doesn’t always happen, so some of the measures to eliminate mistakes have been put to work.

Mainly, they are to fix the issue and, as the last resort, to penalise the taxpayer. These are:

“CPA Australia head of policy Paul Drum said while penalties of up to 200 per cent of tax avoided may be applied under the law, the size of any penalty would depend on the nature of the breach.

“Ordinarily … if a person makes an honest mistake, you’ll have to pay the primary tax, so the tax you avoided plus [interest],” Mr Drum said.

For false or misleading statements, the ATO applies a penalty based on a percentage of the shortfall between the correct tax liability and the amount paid by the individual.

Penalties range from 25 per cent to 75 per cent of the shortfall amount, depending on whether the breach was due to carelessness, recklessness or intentional disregard.”

ABC News

Here are some of the claims that were targeted by the ATO:

“An employee manager claimed $3,800 in work-related car expenses. When we asked the taxpayer to verify that they owned the car and it was registered in their name, we discovered the car was under a novated lease arrangement. Employees who have a novated lease arrangement are not considered to have expenses in relation to the car, as their employer leases the car on their behalf. Claiming a deduction for these expenses is considered double-dipping. All deductions were disallowed and we applied a penalty.” – ATO Media release

“Some examples of the ATO uncovering incorrect claims for work-related deductions include the following:

1) A medical professional made a claim for attending a conference in America and provided an invoice for the expense. When the ATO checked, they found that the taxpayer was still in Australia at the time of the conference. The claims were disallowed and the taxpayer received a substantial penalty.

2) A taxpayer claimed deductions for car expenses using the ATO logbook method. The ATO found they had recorded kilometres in their log book on days where there was no record of the car travelling on the toll roads, and further enquiries identified that the taxpayer was out of the country. Their claims were disallowed.”

Why This Matters: Properly reporting your car allowance is crucial to avoid financial penalties.First of all, check how much you know about what an ATO car expense is and what can or cannot be claimed:

Let’s look into some of the questions people ask when it comes to claiming their work-related car expenses.

You can claim your car for travel between your home and your workplace if:

Work-related car and travel expenses also include the cost of trips:

If the travel was partly private, you can claim only the work-related part. You cannot claim normal trips between your home and your workplace, even if:

The ATO considers business mileage to be the kilometres traveled in a car for work-related purposes. This includes commuting from your usual workplace to meet clients, and:

Be aware that the ATO does NOT generally consider kilometres driven between work and home as “business” travel. Even if you stop off to pick up the mail on the way, or have to take multiple trips each day, travel between home and work is still considered private use.

There are exceptions. For example, if your home is your primary workplace and you need to travel to another workplace this would be classified as business use.

The business will be able to depreciate the business-use percentage of the value of the car.

It is really important to remember that if you are classified as a small business by the ATO then you will be able to immediately claim the entire purchase price of a vehicle costing less than $20,000 including GST. A good incentive not to buy more cars than you really need!

Answer by MJA Business Solutions:

Wouldn’t this be nice? Unfortunately, the answer is no. If you put business advertising on your motor vehicle, the actual cost of the signwriting is tax deductible. However, to claim a deduction for the motor vehicle running costs all the normal rules apply.

Usually, the costs associated with personal use of the vehicle are not deductible. You can only claim deductions for the business use portion of the vehicle expenses, and you need to be able to substantiate these claims with appropriate records, such as a logbook.

If you are paying for your own meals, then it is not a fringe benefit. As meal expenses are generally considered to be a private expense, you will not be able to claim a deduction for your meal, even if it is related to a business matter.

If your employer is paying for your meals, or reimbursing your costs, this is a non-cash benefit and may require your employer to pay FBT. This will depend on the amount and frequency that your employer is paying for your meals. More information on FBT can be found at Fringe Benefits Tax.

As your allowance appears on your payslips, you will need to declare it as part of your taxable income. This is considered a car allowance by the ATO, and it is important to understand the car allowance tax implications.

You may be entitled to claim certain deductions for vehicle and travel expenses. Please refer to vehicle and travel expenses to see if you are eligible and what you will need to claim these deductions.

It’s also crucial to keep detailed records of your travel expenses, including dates, distances, and purposes of your trips, as this information will be required when making your ATO car expense claims.

To claim a work-related deduction:

If you are paid a travel allowance, have a record to prove it.

If you receive a travel allowance:

If you get paid an allowance for some travel expenses (including overtime meal allowances, and domestic and overseas travel allowances), you do not have to keep written evidence of your expenses provided your claim does not exceed the reasonable allowance amount we set for each year.

If you want to claim more than the reasonable car allowance amount we set, you need to keep evidence of your expenditure.

More questions and answers can be found on the ATO community website. You can see the concerns other people had and the answers given to them by other members of the community. You can also post your own questions about the specifics of your taxes and ask for useful tips and opinions.

Since the tax system in Australia depends on Australian citizens being diligent about lodging their own taxes, it is important that you do so properly.

While this sounds reasonable, the Australian Taxation Office still reports that over-claiming taxes is one of the main forms of tax system abuse.

In 2018, the ATO announced increased monitoring of all work-related car expense claims.

You definitely want to make sure your taxes are 100% in order and that’s why you should review your practices and make sure your tax lodging is absolutely flawless.

Here is a checklist you can always come back to:

First of all, you can claim expenses for your own car or a company car. This includes cars that have been bought, but also leased cars.

Keep in mind that a car is considered to be a vehicle that can carry less than a tonne and/or nine passengers.

Two factors are essential to remember:

While keeping these two factors in mind, you can now start to calculate your taxes, using one of the two methods.

You don’t have to hold on to all the receipts if you are using the cent per kilometre method. However, if you are being audited, you have to be able to support your claims and explain your calculations.

As for the ATO logbook method, it is necessary to have a precisely and diligently filled out ATO logbook that monitors a period of at least 12 weeks.

This ATO logbook needs to be updated every 5 years. For each trip, you need the following:

Additionally, you will need the receipts for all the expenses.

Unfortunately, this means that you have to think about all these details every time you drive your car. You need to record the odometer reading, your destination and the reason why you are going there. It takes a lot of time and if you forget any of these steps – you could be in trouble.

One of the easiest, hassle-free and, in the long run, cheapest ways to do this every day is to use your smartphone and an app like GOFAR. The app tracks all the details you need for your tax and more.

What’s even more convenient is that you just jump into the car and start driving. When you’re done, you just swipe left or right and let the app know if that was a business or private trip.

GOFAR then holds on to those logs and you can email them to yourself in two taps on your phone screen. They’re delivered in a convenient spreadsheet format that makes calculations a breeze.

Now that you’ve settled on the ATO logbook method, consider downloading the GOFAR App like thousands of others.

I’ve had a good run with the device and it helps a lot so I don’t need to worry and sweat the small stuff. Ben Douglass, Verified Customer, Mar 2022

With a 4.5 star rating on the App Store, join over 20,000 users worldwide tracking their car expenses with their GOFAR.